luzokeefe4545

About luzokeefe4545

Understanding Gold IRA Accounts: A Comprehensive Guide

In recent times, gold Individual Retirement Accounts (IRAs) have gained recognition amongst traders in search of to diversify their retirement portfolios and protect their financial savings against inflation and economic uncertainty. This report aims to provide a comprehensive overview of gold IRAs, together with their benefits, how they work, the forms of gold that may be included, and the means of setting one up.

What is a Gold IRA?

A gold IRA is a kind of self-directed particular person retirement account that permits buyers to carry bodily gold, along with other valuable metals, as part of their retirement savings. Unlike traditional IRAs, which sometimes hold stocks, bonds, or mutual funds, a gold IRA gives the opportunity to spend money on tangible property which have traditionally maintained their value over time.

Advantages of a Gold IRA

- Inflation Hedge: Gold has long been considered a hedge against inflation. When the value of paper forex declines, the worth of gold usually rises, helping to preserve the buying power of traders’ retirement financial savings.

- Diversification: Including gold in a retirement portfolio provides an element of diversification. Gold typically moves independently of stocks and bonds, which may also help scale back total portfolio threat.

- Tangible Asset: Not like stocks or bonds, gold is a physical asset that traders can hold of their arms. This tangibility can provide a way of safety, particularly throughout instances of economic instability.

- Tax Advantages: Gold IRAs provide the same tax advantages as traditional IRAs. Contributions could also be tax-deductible, and earnings grow tax-deferred till withdrawal, permitting for doubtlessly better accumulation of wealth over time.

- Safety Against Foreign money Devaluation: In occasions of geopolitical uncertainty or economic downturns, gold is commonly viewed as a secure-haven asset. Traders might flip to gold to guard their wealth, rising its demand and worth.

How Gold IRAs Work

Setting up a gold IRA includes a number of steps:

- Choose a Custodian: Buyers should select a custodian that focuses on self-directed IRAs and is authorized to carry valuable metals. The custodian will manage the account and ensure compliance with IRS regulations.

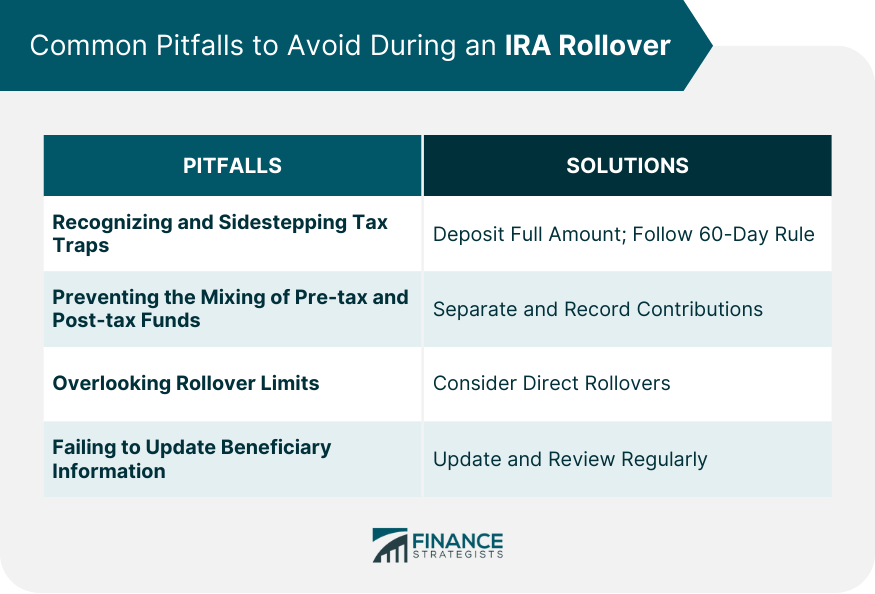

- Fund the Account: Traders can fund a gold IRA via contributions, rollovers from present retirement accounts, or transfers. It is essential to adhere to IRS guidelines relating to contributions and rollovers to keep away from penalties.

- Choose Treasured Metals: Buyers can choose from various eligible valuable metals, together with gold, silver, platinum, and palladium. Nonetheless, the metals must meet particular purity requirements set by the IRS.

- Buy and Store the Metals: Once the account is funded, the custodian will facilitate the acquisition of the chosen metals. These metals should be saved in an IRS-accredited depository to ensure compliance and safety.

- Withdrawals and Distributions: As with conventional IRAs, withdrawals from a gold IRA are topic to taxes and penalties if taken before the age of 59½. After this age, traders can take distributions with out penalties, though they’ll nonetheless incur taxes on the amounts withdrawn.

Sorts of Gold Eligible for Gold IRAs

Not all gold is eligible for inclusion in a gold IRA. The IRS has established particular purity standards that should be met for gold to be thought of a certified investment. Eligible gold will need to have a minimal fineness of 99.5%. Some frequent varieties of gold that can be included in a gold IRA are:

- Gold Bullion Coins: These are coins which are minted from gold and sometimes have a face value. In style examples embrace the American Eagle, Canadian Maple Leaf, and South African Krugerrand.

- Gold Bars: Gold bars are another option for traders. They are available in varied weights and are often produced by reputable refiners. Bars must also meet the minimum purity requirement of 99.5%.

- Gold Proof Coins: These coins are specially minted for collectors and sometimes carry a better worth than their bullion counterparts. However, they should still meet the IRS purity standards.

Setting up a Gold IRA: Step-by-Step Process

- Analysis and choose a Custodian: Begin by researching varied custodians that provide gold IRAs. Look for reputable firms with experience in managing valuable steel accounts, transparent price constructions, and positive buyer evaluations.

- Open a Gold IRA Account: Once a custodian is selected, complete the necessary paperwork to open a gold IRA account. This may occasionally embody providing personal data, financial details, and choosing beneficiaries.

- Fund the Account: Fund the account by means of contributions, rollovers, or transfers. Guarantee that all transactions adhere to IRS rules to keep away from tax penalties.

- Choose Your Investments: Work with the custodian to pick the sorts of gold and other valuable metals to include in your IRA. Guarantee that each one chosen investments meet IRS standards.

- Full the purchase: As soon as the investments are selected, the custodian will facilitate the purchase of the metals. Be sure that the metals are stored in an IRS-permitted depository.

- Monitor Your Investment: Regularly assessment your gold IRA account to trace efficiency and make changes as needed. Keep knowledgeable about market tendencies and modifications in IRS laws which will affect your investments.

Issues and Dangers

While gold IRAs offer several advantages, there are additionally dangers and considerations to keep in mind:

- Volatility: The worth of gold could be unstable, and while it could function a hedge against inflation, it’s not immune to market fluctuations.

- Storage Fees: Buyers may incur storage charges for protecting their gold in an IRS-accepted depository. These charges can differ based mostly on the custodian and the quantity of gold stored.

- Restricted Liquidity: In contrast to stocks or bonds, promoting bodily gold could be less liquid. Buyers could have to find a purchaser or undergo a dealer, which may take time and will result in further prices.

- IRS Laws: Compliance with IRS regulations is essential for maintaining the tax-advantaged status of a gold IRA. Traders must make sure that their investments meet the required requirements and that all transactions are properly documented.

Conclusion

A gold IRA is usually a valuable addition to a retirement portfolio, offering benefits such as diversification, protection against inflation, and the security of tangible property. If you cherished this write-up and you would like to get more information pertaining to trusted options for Gold-backed ira rollover kindly pay a visit to the web-site. However, potential buyers ought to rigorously consider the related risks and work with skilled custodians to ensure compliance with IRS rules. By doing so, individuals can benefit from the unique benefits that gold IRAs offer in securing their monetary future.

No listing found.